Based on your VAT registration, you may calculate your VAT return based on figures from sales and purchase invoices (Standard VAT scheme) or on monies spent / received (Cash Accounting) or you may be on a Flat Rate Scheme, based on your business industry. Please make sure you have the correct VAT scheme selected in system configurations (Settings / Configurations / Company / Details).

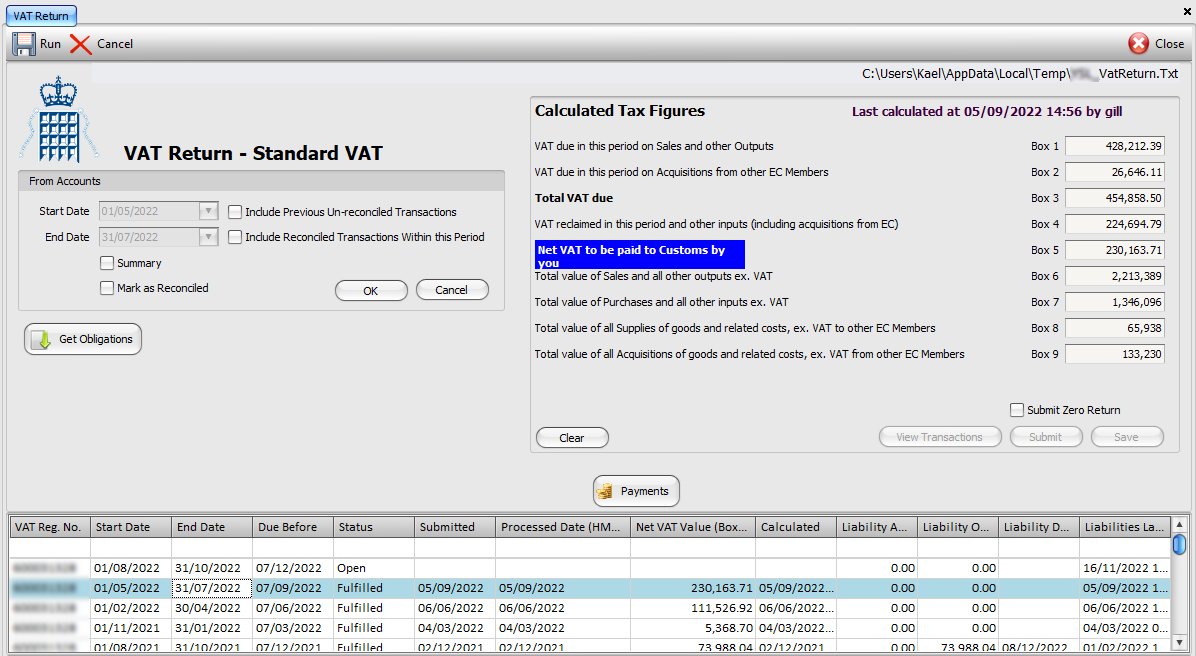

To process your VAT return, simply set the correct start and end dates for your VAT return period and click OK to calculate the figures for your return. Summary VAT Return figures are shown on the screen, to the right and a print dialogue screen is presented to enable you to print the VAT report. It is IMPORTANT that you produce a full VAT report to check that return figures that are calculated are derived from correct entries; make sure there are no errors or omissions (see 6 and 7, below).

Before submitting your VAT return, it is reccomended that you untick this Summary box to produce a detailed VAT report that you can then check to make sure that all the data entries are correct and that there are no errors, ommisions or entries that should not be included.

This section displays the date & time and the logged-in user ID when the VAT return report was generated, above the actual summary VAT return figures. If there is any VAT to be paid to HMRC (Box 5) then this entry (Net VAT to be paid to Customs by you) will be highlighted in blue. However, if you are due any VAT back from HMRC then this entry will be shown in Green and will be titled: Net VAT to be claimed from Customs.

If you are registered for or want to submit your VAT returns using the HMRC new digital platform (Making Tax Digital) the please read the guide, MTD - Making Tax Digital.

When you submit your VAT on line, the associated transactions are automatically marked as reconciled to prevent them being included in future submissions. In addition, you can tick this option and run the report, by clicking the OK button, for a given period to mark those transactions as being reconcelled without having to make a VAT submission. You do not have to print the report for the transactions to be marked as reconciled.